The classic DeFi ponzi game is the shitcoin farm. Essentially, users deposit Ether and stablecoins into Box X in exchange for valueless governance token rewards from the Box X protocol. As more credulous users deposit into the box, a mania develops as investors use measures like “TVL” or “Total Value (temporarily) Locked [in Box X]” to gauge the trustworthiness of a protocol. These investors drive up the price of the governance token in response to the earlier Box X deposits and further increase the rewards for depositing even more TVL in the box. The natural consequence of this behavior is reflexive TVL mooning in the beginning before an inevitable collapse follows.

Getting rewarded for staking Ether is seemingly the same as the shitcoin ponzi game described above, were it not for the fact that Ethereum, Solana, or whatever your L1 of choice is, has the “feudal” privilege of extracing rent from the (nascent) application layer, because most L1 protocols explicitly privilege equity holders with the ability to order blocks. This leads to MEV.

MEV is essentially any value that can be extracted from end users due to one’s ability to order the transactions in single new block added to the “blockchain”. For example, you can literally front run people’s buy orders on Uniswap if you have the privilege to propose a new block. In Proof of Work the privilege of ordering blocks and picking what pending transactions from the mempool will be included in a block goes to the miners, and in Ethereum it goes to the validators. Crucially, in every noteworthy instance of crypto “common law”, whether it be Bitcoin or Ethereum or Solana, the owners of certain classes or derivatives of the protocols equity1 are granted the privilege of ordering blocks. The value of this MEV is more than the block rewards given to the validators of some blockchains like Ethereum.

As the diagram above shows, End Users pay to use dApps, and some of this value is directly accrued to Equity Holders in the form of MEV (and also in some cases indirectly through fees paid by end users that are used to remove equity from circulation). Equity Holders pay some amount of these MEV earnings to Searchers, who are basically math nerds who optimize the amount of MEV that can be extracted by validators in exchange for a cut of the value extracted. It is unclear how much value will be paid to searchers and how much will be paid to validators in the long run at this time. Likely, the two groups will coalesce over time into a single political block.

Additionally, MEV scales to onchain volume and volatility. This should be trivial, as large volume and volatility obviously leads to more DEX arbitrage value. Even in the absence of Uniswap LP’s to beat up on there is plenty of MEV to be extracted from the application layer.

This feudal reward is a concession to the equity holders of protocols. Volatility is transient, and rare, but protocols need to be secured year round. MEV is therefore something of a cost of liveness and reliability for users that they may be happy to pay for in exchange for synronicity with other dApps and the ability to reliably manipulate their DeFi positions at will. MEV is the cost of doing business for these end users. The MEV cost, like normal gas fees, ensures access to the most lucrative financial opportunities and liquidity and correctly prices this access.

Given this feudal primacy that the L1 tokens command, it’s tempting for dApps to attempt to pay for their own security by becoming an independent “app chain”. This comes with considerable CAPEX costs in the difficulty in building up a decent social consensus and diverse validator set however, and sacrifices composability with other DeFi applications. Most likely, only one or two “appchains” (the most obvious being a perp exchange), if any, generate enough value to pay for their own security in the long run.

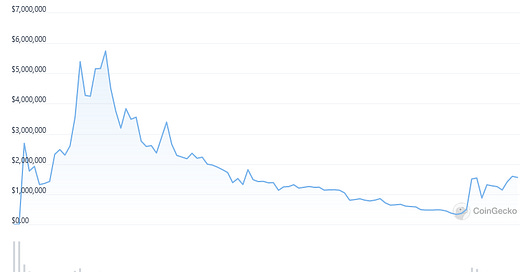

This means that L1 equity can plausibly continue to extract fees from dApp users for the forseeable future. Given this nearly “free money”, it seems rational for nearly the entire float of Ethereum to be tokenized as a LSD or Liquid Staking derivative. Originally, LSD’s were simply a kludge to work around the fact that Ethereum required 32 ether to have a chance at validating new blocks, which was cost prohibitive to many users. Essentially, LSD’s are “validators as a service” and enable you to profit from block validation even if you only have 0.05 Ether. However, LSD’s now exist that redistribute some MEV value back to stakers because there are rewards to validation at scale that make having more capital desirable. This creates winner take all scenarios as many have noted, and it seems guaranteed that the majority of Ether’s circulating supply will be staked in MEV distributing LSD’s in a matter of years, especially as liquidity improves due to the ability to unstake from the LSD protocols and creditors increasingly see LSD’s as THE as prime collateral in DeFi, rather than the normal protocol equity. MEV redistributing LSD’s aren’t just theory either, they exist in practice today through offerings like Jito’s-

In fact, the only reason to hold the normal L1 tokens in a matter of years will be to pay for gas, and eventually even that will be abstracted away once users can pay gas fees in the LSD on Layer 2s. Yields will normalize at some low rate, perhaps 1-5% real return, and Ethereum will become a proper “internet bond” with it’s yield intriguely being based upon future realized volatility on the application layer (remember that MEV scales with volatility). Because low real yields in tradfi should provoke on-chain degeneracy and volatility, Ether seems to be positioned to benefit massively from any long term low real yields in traditional financial markets.

Crucially, however, we must be wary of the L1 layer extracting too much value from the dApp layer. The most profitable dApps will almost certainly seek their own independence, and even the dApps that cannot pay for their own security in the long term may attempt to become independent temporarily if provoked, destroying value for Ether holders in the process.

MEV also bifurcates users into “haves” and “have nots” and reinforces the feudal appearance of Ethereum. This will disrupt the social layer over time unless new shitcoiners reliably become Ether holders themselves, which won’t happen if price appreciation is exorbitant.

In Bitcoin this equity is in the form of a physical future contract (ASICs), in PoS systems like Ethereum the privileged equity is “staked” or “locked up” Ether)